What is the Account Payable (AP) Process?

The account payable (AP) process is responsible for goods and services payment for both suppliers and vendors purchased by the company. In general, the account payable department will handle invoices and bills. But some companies may be large enough to oversee one or more additional functions of the business.

There are 4 major steps in the account payable (AP) process.

- Receiving Invoice

- Invoice Reviewing

- Approving Invoice

- Paying for vendors or suppliers

Basic End-to-End Process of Account Payables (AP) Stages

You know the responsibilities of an account payable (AP) process vary and are difficult. Get a clear picture of the basic end-to-end account payable (AP) process. Here follows the basic end-to-end process of the account payable (AP).

End-to-End Process of AP – Outline

- Procurement – In this process, your company makes a decision to buy something and creates a purchase order.

- Receipt – When goods or services are delivered and when often the vendor sends an invoice

- Payment – When the company is ready to pay for goods or services, ideally after the first two stages.

Three Basic Stages of End-to-End Account Payable (AP) Process | In-Depth

Procurement

The account Payables (AP) Process starts from the moment when you create your company purchase order or PO to submit to one of your suppliers. Remain that account payable (AP) doesn’t start when the company’s bill arrives. This is the first stage of the end-to-end account payable process.

Receipt

In the account payable receipt stage, you include both the delivered goods and services, and when the supplier sends their invoice. Admitting these both documents matters here. Because receiving these documents will help you keep track of payment terms and deadlines.

Payment

Exactly, when the company completes these stages (i.e., purchase order, report of receipts, and invoices) match exactly together, and in final, the payments are approved by the organization and remittance may occur.

Importance of Accounts Payable Management

A solid system of accounts payable (AP) will help you cut costs, manage cash flow, and pay your suppliers on time. Account payable (AP) is important for your business because,

- Maintaining good relations with vendors is a key part of account payable (AP) management because it allows you to ensure that vendors will continue to work for your business.

- The best and essential part of any business is paying vendors on time. Doing so will allow you to maintain good relations with the vendors. So that they continue to work for you. This is one of the primary tasks of account payable (AP) management.

- When you pay invoices on time, vendors will secure an uninterrupted supply of supplies and services. This should be done on time so the other employees can do their jobs properly in a systematic flow.

- The process is said to be the good account payable process, only when they pay their dues on time, by avoiding all their overdue or late fees or penalties.

- You can manage better cash flow for your organization.

- An organized approach to managing your accounts payable will ensure that all the invoices you owe are paid on time. This will reduce the risk of missing payments and prevent duplicate payments.

- Following an extremely proper account, the payable process helps you in avoiding thefts and frauds to a greater extends.

Balancing account payable’s with accuracy helps the company’s financial statement accuracy.

When a company is both a creditor and a debtor for a transaction, the transaction has to be entered into the books twice. If they exchange cash and receivables in different amounts, this will create a discrepancy when the numbers involved are large. Thus, have proper expense tracking is necessary for the payment.

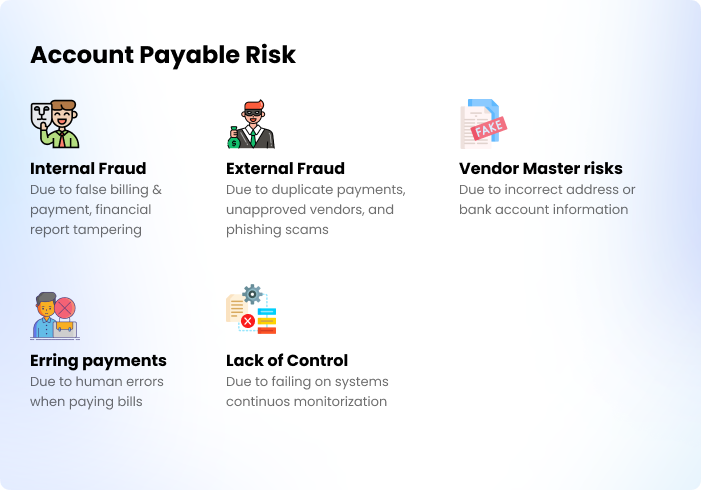

Accounts Payable Risks

Internal and External Fraud

Both frauds are one of account payable (AP) risks.

Internal Fraud includes – Tampering with financial reporting, False billing, False Payment.

External Fraud includes – Duplicate payments, unapproved vendors, and Phishing scams.

Internal Fraud

Financial Report Tampering – This risk comes when an employee performs unauthorized changes to financial data, causing an error in the payment process.

False Billing – In this type of fraud, a company employee prepares false invoices and receives cash or a check from a vendor or customer. In some cases, there may be collusion with an external party.

False Payment – If employees make an unapproved payment through either ACH or check, this type of false payment occurs.

External Fraud

Duplicate payments – Due to fraudulent, vendors receives an invoice in two different form of documents and may pay more than once. This is considered the top account payment risk.

Unapproved vendors – This is because your company can’t verify that the vendor exists and that they provided the goods and/or services.

Phishing scams – This can happen when an outsider makes a false compelling plea to a company to get ahold of confidential data.

Vendor Master

The vendor master is the key to effective AP functionality. An incorrect address or bank account information can cause payments to fail to post on time and wind up to the wrong people.

Errant Payments

Human error is responsible for 1 in 3 business expenses. One of the most likely human errors is making an error when paying bills. Errant payments are always possible. It’s possible, to make duplicate payments, overpay vendors, or make payments for things not owed us.

Lack of Control

Systems that aren’t monitored continuously for their account payment (AP) generate errors, and without controls, they can damage processes. Here exists the lack of visibility. Due to this, the organization fails to provide control.

How to Improve the Account Payable (AP) process?

Ideas to improve the account payable (AP) process are as follows,

- Reduction on paperwork

- Reduction on processing cost and time

- Try to avoid duplicate payments and late payments with the help of automated invoice matching.

- With the help of data, capture reduce your cost and manual effort.

- Gain visibility and KPI analytics across your account payable (AP) process.

- Make use of early payment discounts

- Improve control over security, authorization, and Retention Policies within one cohesive account payable (AP) system.

- Always monitor your important metrics.

- Simplify your work.

Related Article

Accounts Receivable Process Full Cycle | Step-by-Step

The accounts receivable process and the accounts receivable cycle are some of the business’s successful notes. Read more