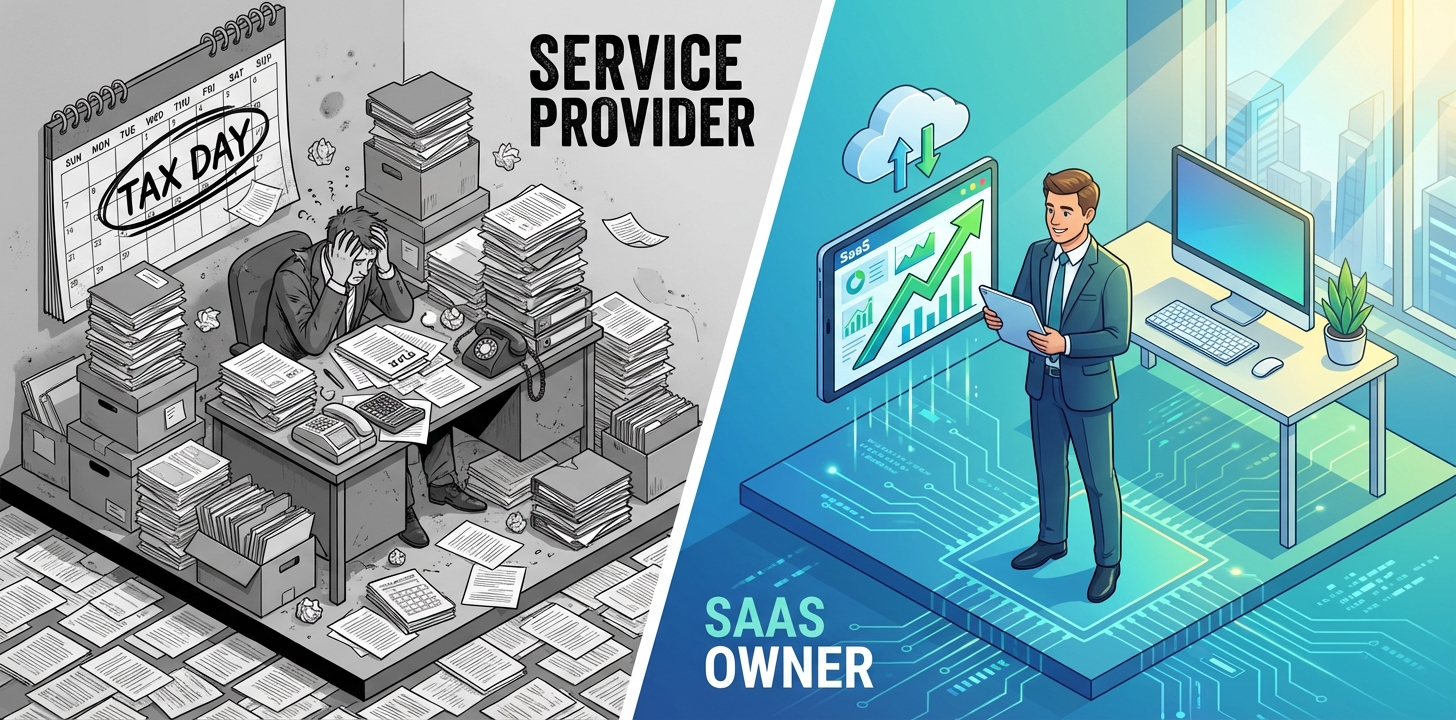

For the first ten years of my practice, my life ran on a predictable, exhausting loop. From January to March, I was a ghost to my family. I lived on caffeine, drowning in a sea of receipts, chasing clients for signatures, and battling server crashes on the government filing portal.

Then came April. Silence.

The revenue dried up. I went from being the most important person in my clients’ lives to an afterthought. I was running a traditional “feast or famine” business. I was selling my time, and there was a hard cap on how many hours I could bill.

The realization didn’t hit me during a seminar or a business retreat. It hit me on a Tuesday afternoon in July when a long-time client called. He needed help organizing his inventory data for a bank loan. I spent three hours fixing his spreadsheets. When I sent the invoice, he grumbled. In his mind, I was the “tax guy.” Why was I billing him in July?

That was the moment I realized: My clients needed year-round support, but I had trained them to only value me during tax season.

I knew I needed to change the model. I wanted Monthly Recurring Revenue (MRR), and I wanted to stop trading hours for rupees. I looked at the SaaS (Software as a Service) model. If I could get my clients to subscribe to a platform I provided—one that handled their invoicing, inventory, and basic compliance—I wouldn’t just be their accounting firm. I would be their operating system.

The Crossroads: Build vs. White-Label

My first instinct was hubris. “I know accounting,” I thought. “I’ll hire a developer and build the perfect software.”

I wasted three months and a significant chunk of savings going down that rabbit hole. I quickly learned that I am an accountant, not a Product Manager. Managing servers, squashing bugs, and worrying about UI/UX was a nightmare. I was trying to build a spaceship when all I needed was a car.

That’s when I found white-labeling.

White-labeling allowed me to take an existing, robust accounting platform and slap my firm’s logo on it. To my clients, it looked like my proprietary technology. It was ready to launch in days, not years. It cost a fraction of custom development, meaning my margins would be healthy from day one.

The First 90 Days

Launching was terrifying. I was afraid my clients would reject it. I was afraid they’d say, “Just file my returns, don’t try to sell me software.”

I started with a pilot group of 10 clients—mostly small retail business owners who were terrible at record-keeping. I didn’t frame it as selling them software. I framed it as a “Compliance Protection Plan.”

I told them: “Stop sending me shoeboxes of receipts. Use this app to invoice and track expenses. It’s my firm’s portal. If you use this, I can guarantee your filings will be accurate, and I can give you monthly profit reports.”

The Migration Strategy

The key was onboarding. I didn’t just send them a login link. My junior staff spent an hour with each client, setting up their items and customer lists. We made it impossible for them to fail.

Once they started using “My Portal” to send invoices to their customers, they were hooked. They weren’t using Tally or Excel anymore; they were using me.

The Aftermath: Revenue and Lifestyle

It has been two years since I made the switch. The difference is night and day.

-

Before: 70% of my revenue came in during a 3-month window. If I lost a big client, I panicked.

-

After: 60% of my revenue is now fixed MRR. The tax filing fees are just a bonus on top of the monthly subscription fees.

But the biggest shift isn’t financial—it’s relational. I am no longer just a necessary evil they visit once a year. Because they use my software daily, I have real-time access to their data. I call them before they have a cash flow problem. I’ve transitioned from a reactive tax filer to a proactive business partner.

If you are a CA sitting in your office right now, dreading the next busy season, stop looking at yourself as a service provider. You have the trust. You have the expertise. Own the platform, and you own the relationship.