A budget is a crucial ingredient for the establishment of any organization. Additionally, an organization’s financial as well as operational goals depend on the budgeting of business. If elaborated, growth of resources, profit line of business, and infrastructural areas totally depend on the budgeting of a business.

A well-written budget will effectively communicate information about the business to management, investors, and other stakeholders. If we think to establish a company, then business budgeting plays a vital role because a good budget, for your business, can make fly you high, while the improper budget for your business can create light risks. Also, once your business is established, budgeting for your organization becomes a regular task that can be done normally on a quarterly and/or annual basis.

There are different types of business budgets to help business owners and executives. The budgeting of business depends upon the company’s VARIABLE & FIXED pay and on the basis of this, funds are allocated. Different companies have different terms used for budgeting purposes such as cash flow, etc.

The first step is to set up a plan for the upcoming year on a month-to-month basis. Starting with the first month, establish specific budgeted levels, particularly for each category of the budget in your business. The sales numbers will be a critical and important asset since they will be used to check gross profit margin and further help in determining operating expenses, as well as the accounts receivable amounts and inventory areas that need to be improved in order to enhance business growth at the next level.

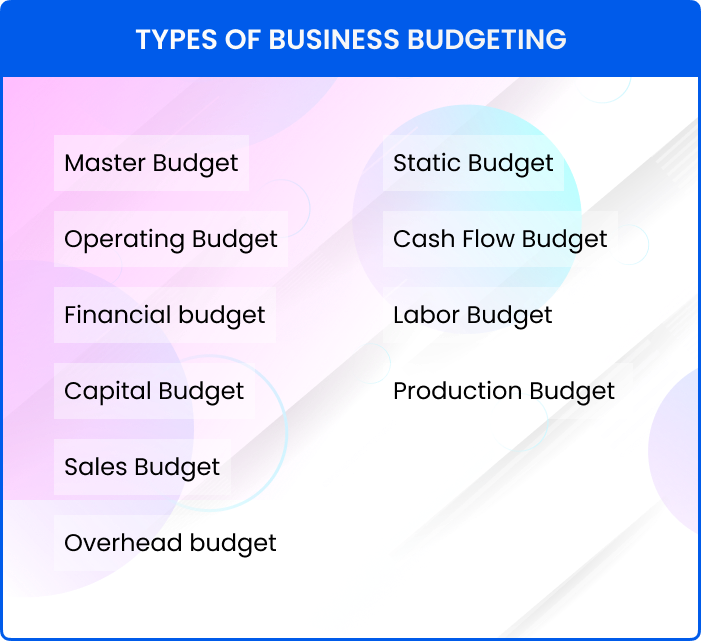

Types of Business Budget

Here are the types of business budgets used commonly. Every business can follow these different types of budgets:

- Master Budget

- Operating Budget

- Cash Flow Budget

- Financial budget

- Production Budget

- Capital Budget

- Overhead budget

- Sales Budget

- Labor Budget

- Static Budget

Master Budget

A master budget is an aggregate of a company’s individual budgets, which is specially designed to present a complete picture of the financial activity and health areas of a company. The master budget combines your business factors such as sales, operating expenses, assets, and income streams to allow companies to look for the establishment of goals and evaluate their overall performance accordingly. It also looks for the individual cost centers within the organization. Master budgets are often used in larger companies to keep all individual managers aligned about business management.

Operating Budget

The operating budget is a forecast and detailed analysis of the projected income of the company and overall expenses over the course of a set time frame. To create an accurate picture of your business, operating budgets must be aligned for different factors such as sales overview, production management, labor costs for resources, materials costs of the product, overhead count, total manufacturing costs, and administrative expenses. Operating budgets are basically created on a weekly, monthly, or yearly basis. A manager might compare these reports month after month to see if a company is growing in a good phase or the set budget needs to be modified.

Cash Flow Budget

Cash flow budget, also known as cash budget. This cash budget is a means of projecting how and when cash comes in and flows out of your business within a specified time period. This type of business budget can be useful in helping a company, determine the profit areas of business, and regulating the growth of the company at the next level.

Financial Budget

The financial budget deals with all the transactions in terms of assets and liabilities of a particular project within the company. The financial budget provides a clear vision of your business’s financial health, and the information can be of crucial importance when seeking funding or a merger.

Sales Budget

The next type of business budget is the sales budget. When you’re managing your sales budget, you’ll want to keep close tabs on your projected sales revenue and expenses to accurately project when your business will become profitable. Creating a sales budget helps you to plan and adjust your spending. Here are the requirements to make the sales budget.

- List all your business offerings

- List all the price points for those offerings.

- Create projection by reviewing last period’s sales budget.

A sales budget is an almost essential tool for making sure you have the right amount of inventory and materials to keep up with customer demand. The sales budget also helps you plan for any unexpected increases in customer demand.

Labor Budget

If you’re thinking about hiring employees, it’s helpful to have a plan in place for, how many employees you need to make sure they can handle the workload. A labor budget helps you figure this out. The labor budget also helps you for allocation seasonal worker expenses.

Static Budget

This type of business budget is for businesses, especially those that have their predictable sales and budget. From the name static budget, this budget will not vary throughout the year. A static budget is used to determine the variation between actual line items and budgeted items. This business budget is used by most businesses to evaluate their sales performance.

Some static budget item expenses are – Subscription fees, Utilities, Software, Warehouse rent, and Contractor fees.

Production Budget

Knowing your production budget helps you determine each product’s sales needs and requirements for the inventory. Production type business budgeting helps you in determining the

- Overhead

- Direct materials

- Direct labor

If you’re not sure what production budget is, it’s just a simple calculation that involves three things: Ending inventory required level, if applicable – some units in the beginning, expected amount of units to be sold.

Your production business budget helps you in calculating the production price and deciding the product cost. Adjust your production business budget based on an increase or decrease in your sales and demand.

Capital Budget

For purchasing large assets, the business budget, we use is the capital budget. They may include – Vehicles, property, and machinery. This capital budget gives you the expected payback period and whether the potential return on investment (ROI) justifies your purchase.

Overhead Budget

An overhead budget is an accounting document that details the fixed and variable overhead costs of a business. As per the name, the fixed costs will stay fixed with no change on your sales, and variable costs will vary based on your activity on sales. By using the overhead budget, you can outline both the fixed and the variable overhead costs.

The Bottom Line

The benefits of budgeting can be elaborated as the best source for the success of your business. It enables the businessmen to regulate the cash flow, reducing the expenditure and hence improving the overcome inputs of business.