In order to follow all the GST requirements, everyone needs to file GST returns from time to time. These returns are important to get a clear idea about income details that are further useful for the calculation of annual tax that is required to be paid to the government.

There are three important GST report types that you may be required to fill depending upon your type of business. Here we have highlighted a few essential details about filing each one of them to ease the struggle for the beginners.

GST Reports; GSTR-1, GSTR-2 and GSTR-3B Explained:

It is vital to know the amount you should pay as your tax liability and if you are eligible for any refund on your GST. GST report or return is a mechanism that summarizes the GST received and paid by you. It shows how your GST was calculated and ensures credit flow to the proper recipient.

GST returns is categorized into different categories, there are GSTR-1, 2, 3, 4, 5…11. Some of these GST returns are further broken down, but the primary concern of this article is on GSTR-1, GSTR-2, and GSTR-3B.

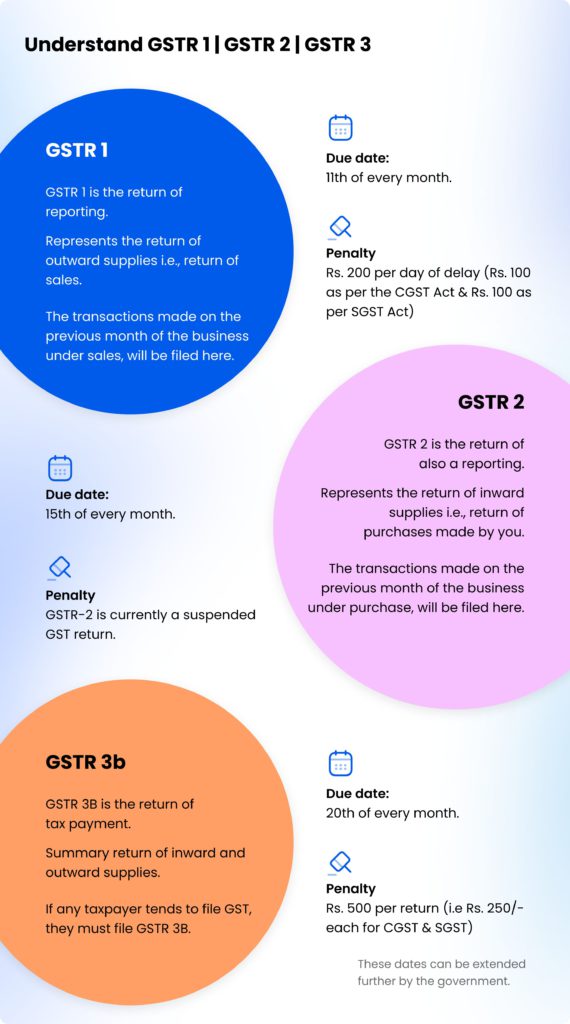

Difference between GSTR-1, GSTR-2 and GSTR-3B | Infographic

GSTR1 or Sales Report

All registered taxable suppliers file this tax return. It comprises details of sales (also known as outward supplies) of taxable goods and services. It is paid monthly or on a quarterly basis depending on your rate of turnover. If your turnover rate is above Rs.1.5 crores, you will file GSTR-1 on a monthly basis, but if it is below the amount, then you will file it quarterly.

All registered taxpayers must file GSTR-1 except for the composition dealers, input service distributors, non-resident taxable persons, and persons liable to collect either TCS or TDS. The penalty for late filing is Rs.50 and Rs.20 per day.

Who needs GSTR 1?

All the registered dealers need to file GSTR 1. It is considered mandatory irrespective of sales and transactions of the particular month. It clearly means that even if the dealer receives no transactions or sales in any month, still he has to file GSTR 1. However, the entities and individuals are exempted from this report. Here is the list of people who need not file GSTR 1:

- In case if your business receives some invoices for the services that are accessed by other branches, you are considered as an input service distributor as per GST norms.

- Those who have registered their business under composition scheme specified by GST, you need to file this report. Note that businesses that have an annual turnover of around 1.5 crores can work under this scheme right from 1st April 2019.

- The suppliers of retrieval services, database access and online information.

- You belong to the category of a non-taxable person if you import services and goods from outside India or taking responsibility for business on behalf of some non-resident Indian.

In order to file GSTR 1; you must have a genuine and valid Goods and Service Tax Identification Number. The sign-in credentials for the portal, valid digital signature certificate and Aadhar number are also important. One should also have access to the mobile number that is mentioned in the Aadhar card.

GSTR2 or Purchase Report

Just as the GSTR-1 mentioned above deals with outward supplies, the GSTR-2 deals with inward purchases of taxable goods, services or both. GSTR-2 is a monthly inward supply report, which can also include reverse charge transactions. It is used to do buyer-seller reconciliation, also known as invoice matching, by the government.

It is compulsory for every registered taxpayer to file GSTR-2 monthly but for businesses with an annual turnover below 1.5 crores, the tax will be paid quarterly. Suppliers must file this return even when no purchases are made as there is a penalty of Rs.100 per day to a maximum of Rs.5000 for late filing.

As GSTR-2 is auto-populated base on the details of the GSTR-1, it takes less time to file, and with your online accounting software, it is even simpler. You must note that if you do not file GSTR-2, you cannot proceed to file GSTR-3.

Who needs GSTR 2?

GSTR 2 is applicable to almost every registered person except the non-residential taxable person, input distributor, and e-Commerce operator.

In case if you import goods and services; you are liable to file GSTR 2. The process of filing GSTR 2 is quite easy; you can complete all formalities by using the common portal. Many businesses prefer to use GSTR 2 just to ensure that vendors are following tax compliant and are registered to the GSTN.

GSTR3B or Tax Summary Report

This is a non-revisable monthly tax filing by registered suppliers. For each GSTIN a taxpayer possesses, he must file a GSTR-3B. This means that if you have multiple GSTIN, you must file multiple GTR-3B. All casual/normal taxable persons must file this tax return every month. In fact, if there is no transaction in a particular month, “Nil” returns must be filed. The refusal to file this tax return as of when due attracts a late fee penalty of Rs.50 per day for normal taxpayers but for taxpayers with Nil tax liability, the penalty is Rs.20.

However, non-resident taxpayers, suppliers who enjoy composition scheme, input service distributors, database access or retrieval services (OIDAR), online information suppliers, Tax deducted at source (TDS) deductor, and Tax collected at source (TCS) collectors do not need to file GSTR-3B.

Who needs GSTR 3B?

GSTR 3B is for all taxpayers that are registered as per the GST regime. Even if your monthly transactions are not significant or are nil; then also you need to file GSTR 3B forms on a regular basis. However, people that are working as composition dealers; input service distributors; suppliers of retrieval services, database access, or online information, or the non-resident taxable Indians need not file GSTR 3B.

It is required to provide all the available input tax credit (ITC), a summary of the information of purchases and sales, tax payable, as well as tax paid in the report.

For a thorough, fast, and easy filing of your tax returns, consider using GST accounting software and follow the step-by-step procedure of tax filing on any of your devices in real-time. One can take help from Cas to file these forms or follow instructions given on the portals online.

FAQs

What is GST Report?

The GST report is a type of report that prints your paid and received GST summary, which is broken down into different tax codes. It is utilized to determine your GST refunds or payments. By knowing the priority, businessers must make a return. The GST report is printed by displaying your business transactions, offering a standard reference as to how your business GST was estimated.

What details does GSTR 2 provide?

GSTR-2 gives the details of your business monthly tax return displaying the complete number of purchases that you made for that whole month. When the businessers make purchases from the respective registered vendors, the data from the GSTR-1 will be there in the GSTN portal in the form of GSTR-2A for you to utilize in your GSTR-2.

What’s the difference between GSTR 1 and GSTR 3B?

GSTR 1 is a return of reporting. It is filed by the taxpayers either monthly or quarterly. This return indicates your return on outward supplies, which is nothing but a sales return.

GSTR 3B is the return of tax payments. This return indicates your return on both inward and outward supplies (i.e., sales return and purchase return respectively).

What’s the difference between GSTR 1 and GSTR 2?

GSTR 1 is nothing but the return of reporting about your business. This type of return is filed by the normally registered taxpayers either once a month or quarterly. It represents your business sales return (outward supplies).

GSTR 2 is also the return of reporting about your business. This type of return is also filed by all taxpayers either once a month or quarterly. It represents your business purchase return (inward supplies). GSTR 2 is currently suspended. This return is not in use from sat September 2017. The data on this GSTR 2 return had to be auto-populated from the GSTR-2A return.

What is R1 R2 R3 in GST?

The R1, R2, and R3 in GST represent the GST R1, GST R2, and GST R3. Here the

- R1 in GST represents sales return (outward supplies)

- R2 in GST represents purchase return (inward supplies)

- R3 in GST represents both sales return and purchase return (outward and inward supplies respectively)

Can I change GSTR 1 quarterly to monthly?

Yes, the taxpayers can modify the GSTR 1 filing frequency to either monthly or quarterly. But for business taxpayers holding their respective annual turnover of 1.5 crores or more than 1.5 crores, must file their sales return every month.

Related Article

Complete GST Guide

Explore GST and know the GST-related updations here. Read more

GST Reports (GSTR-1, GSTR-2 and GSTR-3B Explained)

There are three important GST report types that you may be required to fill depending upon your type of business. Read more

GST Filing Process for Small Business

The GST filing process for small businesses is also considerably important similar to large businesses. Read more

GST Annual Return | GSTR 9, GSTR 9A, GSTR 9B, GSTR 9C Explained

GSTR 9 is an annual return. This GSTR 9 annual return should be filed once a year by the taxpayers who are registered under GST. Read more

All you need to know about GSTR 2, GSTR 2A & GSTR 2B

Explore GSTR 2, 2A, and 2B with their differences. Read more