What is purchase return and allowances?

Definition: It is an account that is paired with and neutralizes the purchases account in a periodic inventory method.

In simple terms, the purchase returns (which are called refunds) and allowances are issued by the suppliers, on originally purchased products for resale.

When to make the journal entries here?

When the goods purchased on the account are returned, or when there exists a request on allowance, the businessers will make the entry for this purpose as purchase return and allowance entry.

Description

In merchandising, when the customer returns the purchased single or multi-products or goods to the respective seller, it is the return occurring point.

In general, when the customer request to refund or price adjustment in the purchased product/products, the buyer will reach the supplier in writing. This type of information on writing is called a debit memo.

The debit memo is nothing but an information document shared by the product purchaser. The document holds the cost by which the purchaser offers to debit the seller’s account.

This document will act as a voucher for purchase return and allowance journal entry. And finally, all the received debit memos will be numbered in series.

Accounting Treatment

The purchase return and allowance accounting treatment is equivalent to sales return and allowance accounting treatment. The only difference between the both is, they involve different accounts.

For example, consider the XYZ company purchasing 10 refrigerators to resale for the total cost of $3000 in the future. Using the periodic inventory system, the businesses record their payable cost. It is documented as a record at the gross or invoice price.

If one of the purchased refrigerators is found bad and it is returned. The XYZ company will make the below entry,

The offset is made on purchase returns and allowances accounts against the entire purchases while estimating the COGS.

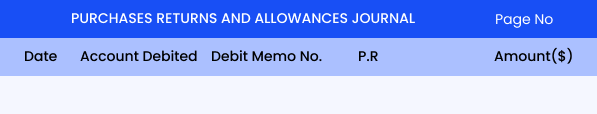

Structure of purchase returns and allowances journal entries

Here follows the general structure of purchase returns and allowances journal entries below,

Here follows the explanation for each of the above-mentioned columns,

Column 1 – DATE

This column holds the date of the returned product to the supplier.

Column 2 – ACCOUNT DEBITED

This column holds the supplier name to whom the product gets returned.

Column 3 – DEBIT MEMO NO.

This column holds the record with the ID number of the respective debit memo.

Column 4 – P.R

P.R stands for posting reference. The P.R column holds the history of the supplier account number. It presents the posted entry to the ledger account.

Column 5 – Amount

This column holds the history of merchandise returned cost.

Purchase returns and allowances journal entries example

Entry created on purchase returns and allowances journal is published on account payable subsidiary ledger (i.e., it contains the detailed data backup as compared to the general ledger) and the general ledger.

Here follows the step-by-step process of the journal entry,

On the account payable subsidiary ledger, the respective cash amount is updated to the corresponding accounts debits.

The entire amount is updated as the accounts payable account debit. Further, posted as the credit in the general ledger.

Purchase returns and allowances journal entries examples

Let us consider the company XYZ. It is engaged in the below following transaction for the year 2021.

(Here for an example, we included corporations 1, 2, 3, 4, …)

Aug 03: From corporation 1, company XYZ purchased merchandise on account, for $751, with invoice number 203.

Aug 13: From corporation 2, company XYZ purchased merchandise on account, for $2500, with invoice number 213.

Aug 15: Merchandise returned to corporation 1 – $100, Debit memo No. 743.

Aug 17: From corporation 3, company XYZ purchased merchandise on account, for $200, with invoice number 220.

Aug 20: From corporation 1, company XYZ purchased merchandise on account, for $350, with invoice number 243.

Aug 22: Merchandise returned to corporation 3 – $45, Debit memo No. 744.

Requirement

The above data transaction information is recorded both on the purchase returns and allowances journal and the purchases journals.

Update all the entries on the subsidiary and general ledger of account payable.

Answers

Purchase returns and allowances journal and purchase journal:

Accounts payable subsidiary ledger

General ledger

The Final Words

To make the journal entry process easy and effective, using software is the best option. mybooks is the best free accounting software to use with journal entries. Start for free!

Purchase Return Journal Entry | FAQs

In trial balance, purchase returns are debit or credit?

Purchase return will decrease the business expenditure. Thus, it will be put on the trial balance’s credit side.

Does a purchase return an expense?

Purchase return cannot be viewed as a business expense. It assists you in expense reduction in business. It can be viewed as a contra expense account.

What’s the difference between sales return and purchase return?

Here we have shared the major difference between sales return and purchase return.

- Sales Return – It refers to the inventory returned by the customer.

- Purchase Return – It refers to the inventory purchased from the supplier which is returned to the supplier.

What is the difference between purchase and purchase return?

If a business purchases goods, those goods are entered in purchase books. If you return those purchased goods, then those will be entered in the purchase return book, as a note that the purchased goods are returned

Related Article

Sales Return Journal Entry | Explained with Examples

In terms of payroll journey, the sales return is that which ought to be helpful for the returning customers in account books. Read more