Businesses are built with the foundation of sales, marketing, and accounting. These three components play a major role in businesses’ day-to-day routine.

The accounts receivable process and the accounts receivable cycle are some of the business’s successful notes.

In this article, we discuss

- What is AR?

- Basic AR cycle

- The complete cycle of accounts receivable | Step by step

- Journal Entry for Accounting Receivables

- Optimization tips for AR

- Importance of AR management

- Simple software for AR management

- Pros of using software for accounts receivable

What is Accounts Receivable (AR)?

Accounts receivable states the cash owed by the company from its company, or it can also be stated as the outstanding invoices that the company holds. In simple words, The AR indicates all the business outstanding invoices you have yet to collect.

The AR is considered to be the current assets on the company’s balance sheet.

What is the Accounts Receivable Process?

The accounts receivable workflow will furnish money to the business. This process is accomplished through various processes, such as invoicing and further collection process which brings cash from the sold product or services.

The main purpose of this business process is to bring money into the company before invoices become past due or bad debts. Finally providing, healthy cash flow for business profit and growth.

Let’s dive for,

- The basic cycle of the accounts receivable process.

- Complete accounts receivable process

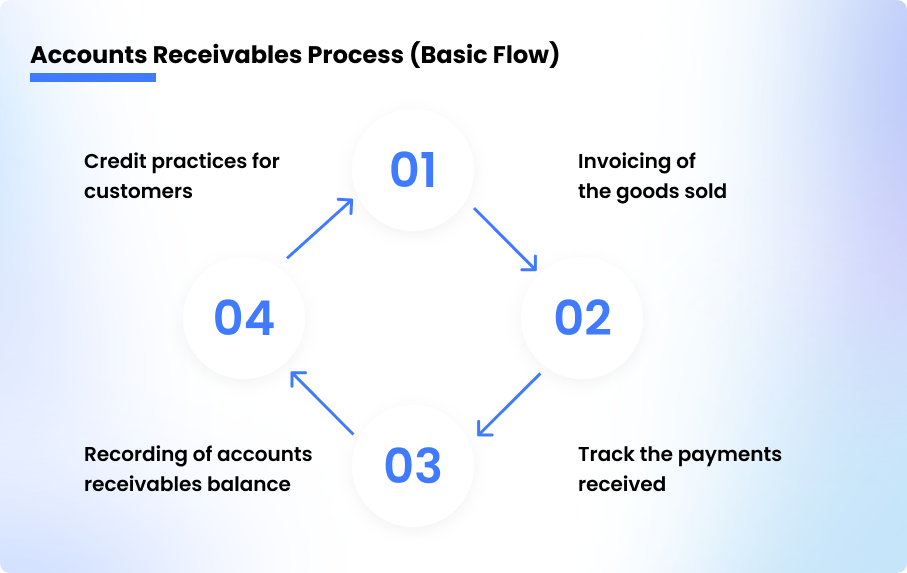

Basic Accounts Receivable Process

Here is the basic cycle of account receivable. As in the image, the basic accounts receivable process has 4 steps.

Step 1: The organization will decide its credit practices for clients.

Step 2: Invoicing the goods that were sold to the respective clients.

Step 3: The next step is to track and follow the payments, i.e., received payments and not received which is to be received.

Step 4: Recording of the accounts receivables balances by the respective accounts

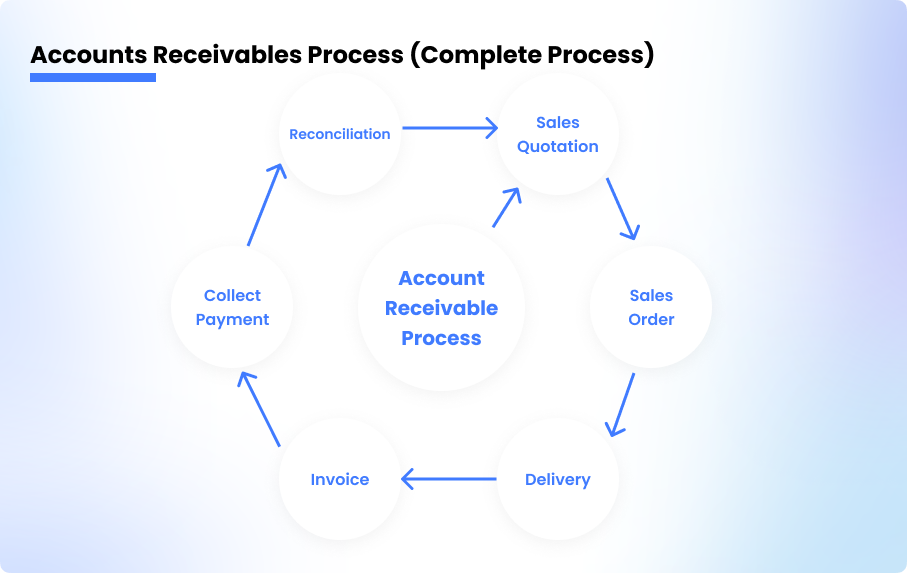

Accounts Receivables Process Flow Chart

As discussed earlier, accounts receivable is the cash amount that a company has the ownership to collect the amount due from their respective client who bought products or services on credit.

Step: 1 | Sales quotation

The first step in the accounts receivable process is sales quotation. Here the quotation is the document, and the supplier will share the quotation with the customer. The quotation will hold the details regarding — product details, the price for every product or service, payment terms, and delivery time.

Step: 2 | Sales order

In this step, you need to document the sales order. This document is for confirmation of sales as the order is received from the client for products to be delivered.

Sales order represents the quotation date, cost for every single unit (or whatever based on the product or services), delivery time, the payment terms, and their respective shift to address.

Step: 3 | Delivery

As per the flow, the next step on the accounts receivable cycle is delivery. The supplier should deliver the respective goods to the mentioned client on time with the invoice and delivery challans.

On the other hand, the receiving person from the customer side should update the company stamp, signature, and contact number on the delivery challan. This process is done for records and future reference purposes.

Additionally, the client should cross-check the received product as satisfies the invoice. If there exists any damage to the received goods, the buyer should make sure to inform the supplier.

Step: 4 | Invoice

With the help of the invoice, the supplier can notice how much cash they owe from the client. The invoicing document will hold the client’s all the products and services details they received.

The supplier needs to issue both the invoice and the signed delivery challans to the client. Further, the supplier should record the exact invoice on the accounting system.

Accounting entry in the seller accounts book

Customer Account Dr

To Sales @10%

To Output SGST@5.5%

To Output CGST@5.5%

Where, SGST – State Goods and Service Tax

CGST – Central Goods and Services

Accounting entry in the buyer accounts book

Purchase Account Dr

Input CGST @5.5% Dr

Input SGST @5.5% Dr

To Vendor Account

Step: 5 | Payment from customer

On the accounts receivable cycle, the next flow is payment from the customer. The supplier has the ownership to collect the outstanding payment from the respective client as per the invoice, who purchased from that supplier.

As per the indicated terms, the client should make the payment on or before he due to the supplier.

Occasionally, if the buyer receives service, then they should deduct TDS. So the supplier should record the payment transaction and that must be cross-checked with the invoice total amount.

Accounting entry in the seller accounts book

Bank Account Dr

To Customer Account

Accounting entry in the client/buyer accounts book

Vendor Account Dr

To Bank Account

Step: 6 | Reconciliation

The supplier should process the vendor/customer-wise reconciliation if the ledger balances look mismatched between the seller and buyer accounts book.

Example

Consider John and Heman as buyers and sellers. Heman sold the product to John for $1250. During the process of accounts finalization in Heman’s books of accounts receivable payment from John should display $1250, and in John’s books of accounts payable payment to Heman should show $1250.

In the accounts book of the supplier, the customer name will display on the company’s balance sheet beneath sundry debtors.

In the accounts book of the client, the supplier’s name will display on the company’s balance sheet beneath sundry creditors.

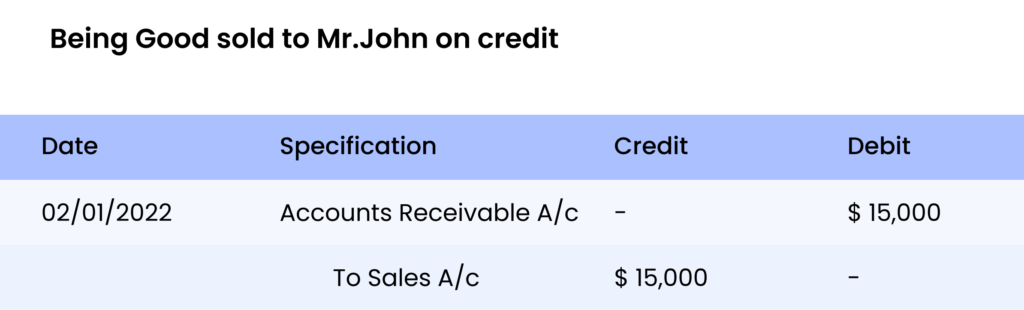

Accounts Receivable Journal Entry

For the AR journal entry, let’s consider an example. The company XYZ has sold some amount of truck parts to Mr.John on credit. Since XYZ company has already incurred diverse expenses which are known as the COGS (cost of goods sold) for their deals but have not been paid.

When Mr.John pays his amount based on billing, the AR accounts get written off against obtained payment in cash. Regardless, if the respective payment is not received or might not be received for the next short duration, then consider it to be a loss. So, the seller can set it as an expense against bad debts.

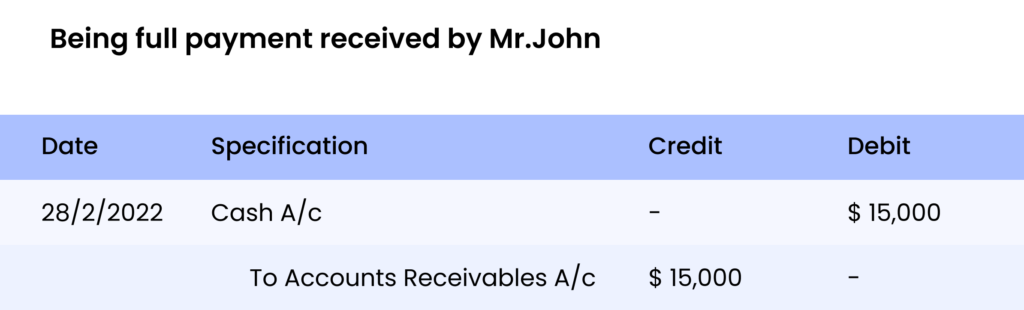

Now, let us enhance the above journal entry example, by journalizing the corresponding transactions step by step.

- On Feb 1, 2022 XYZ company sold some amount of truck spare parts to Mr.John on credit. The amount on the invoice with all taxes and expenses was $25000, which has to be paid on or before the month-end i.e, before Feb 31, 2022. Mr.John made the full payment on Feb 28, 2022.

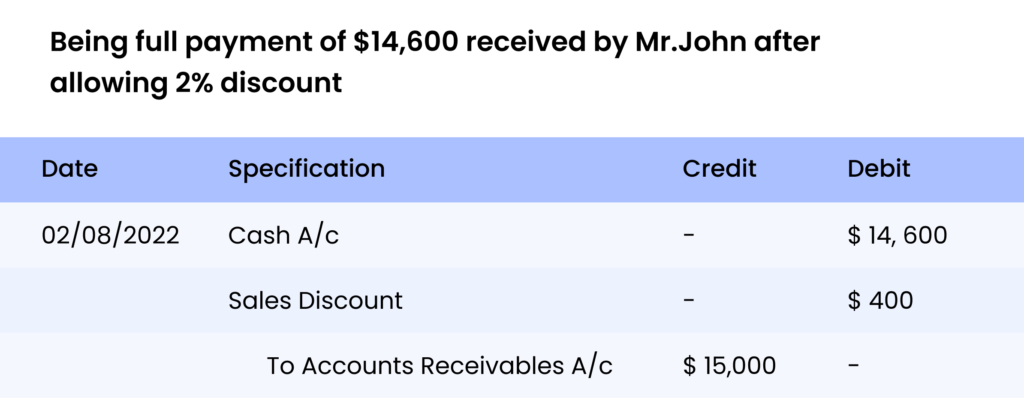

- Recording and documenting the credit sales if XYZ company issues credit terms to its clients. Now, let us consider the credit terms 2/10 net 30. 2/10 net 30 is nothing but — if the amount is delivered within 10 days, 2% discount is presented, else the whole payment must be done before the ends days (30 days), without any discount.

- Finally, Mr.John pays the total amount on Feb 9, 2022, and receives the discount.

Accounting for Bad Debits

While the company makes sales on credit, the company is well known that not all the debtors (i.e., borrowers) will pay the whole amount. So, the company has to face some losses, which are known to be bad debts.

There are 2 methods to record the company’s bad debt. One is using the allowance method and the other is using a direct write-off method.

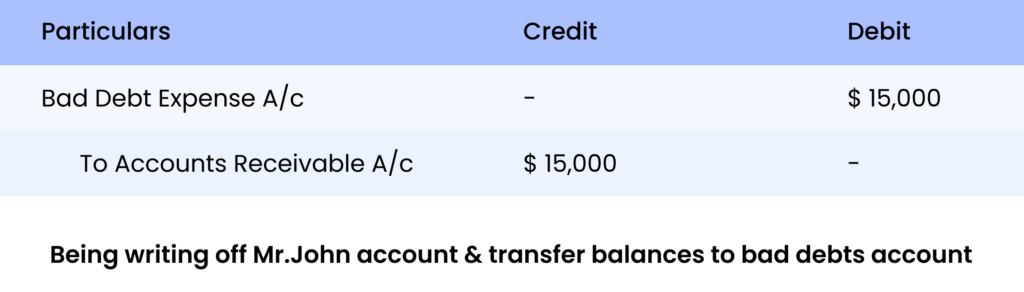

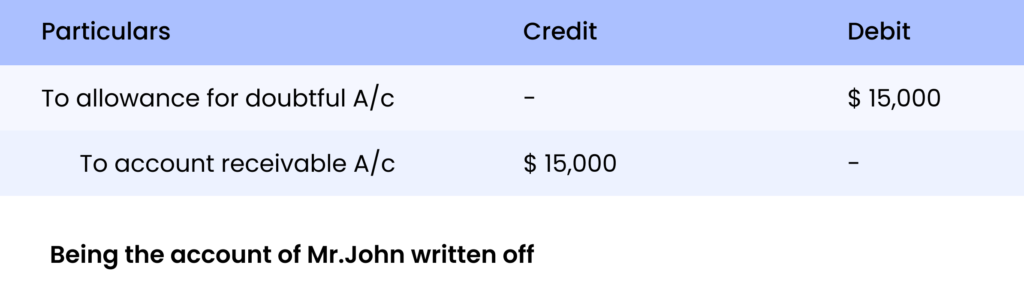

Recording bad debts using the direct write-off method

Bad debts provision is documented and recorded as defaulters’ direct loss, writing off their accounts and moving the total payment to the Profit and loss account, thus reducing your net profit.

For example, let’s assume Mr.John has passed and finally, nil payment made by him.

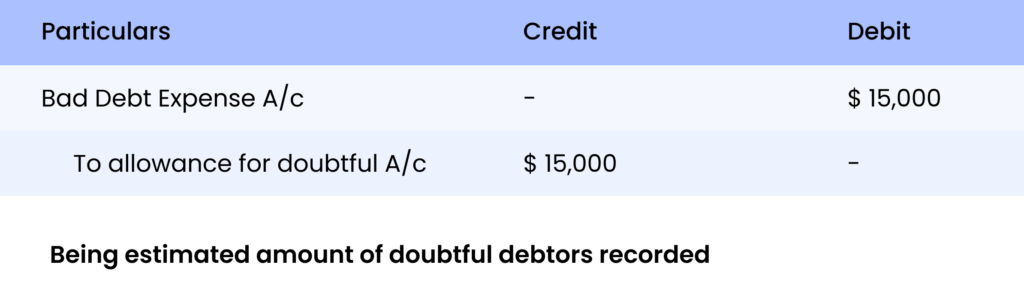

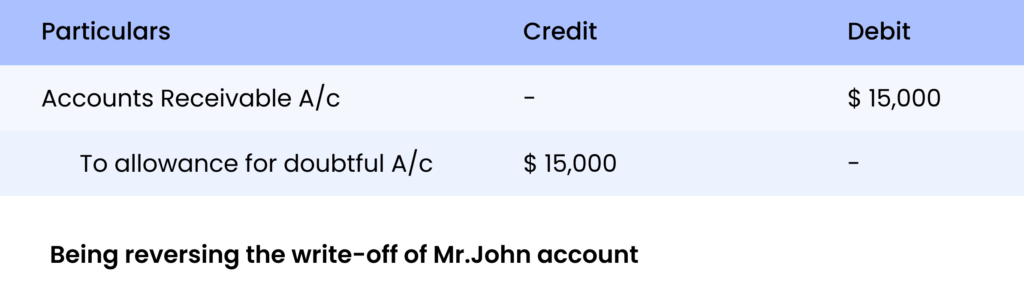

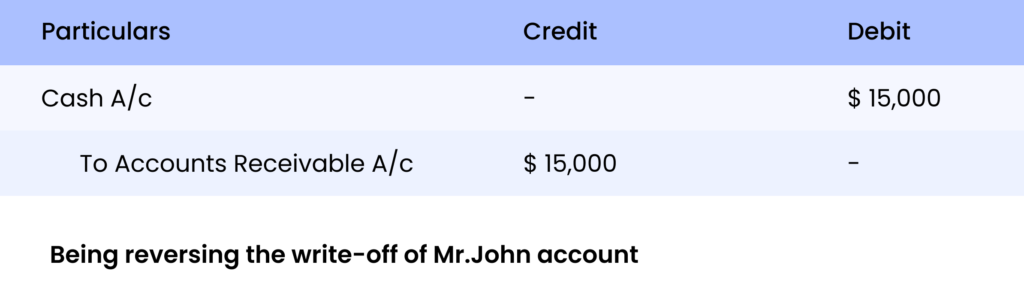

Recording bad debts using the allowance method

Charging the reverse value of AR for the customers who are doubtful to a contra account is known to be an allowance for a doubtful account. This will hold your profit and loss account undisturbed and unaffected from bad debts, and finally documenting and reporting the final loss against revenues can be bypassed. Regardless, writing off the account for the future date is feasible.

- Assuming Mr.John has undergone some losses and thus, he failed to accomplish payment at and before due dates

- Assuming, Mr.John goes collapsed and bankrupted. So, he can’t able to make his payment.

- Assuming, that Mr.John has rebounded from initial flops and likes to pay all his earlier debts.

Tips to optimize accounts receivable process

Optimizing the process or the cycle accounts receivable process may feel difficult. But with suitable techniques and methods, you can effectively improve the flow of AR. Here are the five activities that help to optimize the AR process.

Maintain the accurate buyer’s data

Maintaining the buyer’s data accurately is one of the pillars to improve the AR cycle. For instant, an incorrect address can generate invoices to be reached at the mismatched place, resulting in a delay in payment. Audit the customer account like unusual payment terms, discounts, credit limits, and other elements regularly.

Properly document the modifications on customer data and make sure your data are placed in the right place.

Prepare a report on aging A/R

Create the accounts receivable report based on aging. It will help you to track the payment status of all your buyers.

As all we know, accounts are separated by the issued number of days on the invoice, like

- From 0 to 30 days

- From 31 to 60 days

- From 61 to 90 days

- Exceeding 90 days

This document will also list the customer’s due amount. Once you update this report regularly, it is easy for you to track before the bill evolves past due.

Another method that helps to estimate either the Accounts Receivable Turnover for your company or the no. of times per year that your company gathers its average AR is,

Net Annual Credit Sales ÷ ((Beginning AR + Ending AR) / 2)

This analysis assesses your business’s capacity to allocate credit and manage funds promptly.

Rapidly clear the past receivable dues

Research shows that, if the supplier goes longer duration with uncollected receivables, they are less likely to collect them either part or as a whole payment. So businesses should be more aware of past dues.

Make sure your accounts receivable manager should connect and contact the customer on the first date of late payment. Have penalties and remind about it your respective client before the due dates arrive. Following this will improve your AR process flow.

Offer discounts for early payment

Offering discounts to customers will encourage them. Try to offer — 2/10, net/30 discount, so that customers can get 2% off discount if they process the payment within 10 days, without taking the payments days for 30.

Following this type of method will help boost your client more and intimate to make the payment as soon as possible without making a delay.

Payment plan for your clients

One of the reasons that the clients reach outstanding due dates is because they are unavailable the pay the total cash amount. So make a payment plan. So that this will guide your business and will take the business a long way by optimizing and improving the business accounts receivable cycle.

Importance of Accounts Receivable Management

Accounts receivable is one of the pillars of the company. The company’s future depends on it. It is hard for a business and impossible to run the business with this key feature. With the proper accounts receivable, you can attract the businesses more effortlessly, as the investor will come forward with this key factor.

It was possible to create a business or destroy a business with the accounts receivable management. When a company faces a delay in payments then, the company will face having poor business cash flow. Finally, the company is in the stage where it cannot pay its bills and fails to run the business smoothly.

Based on the research conducted by experts, most businesses shutdowns their companies, due to poor cash flow.

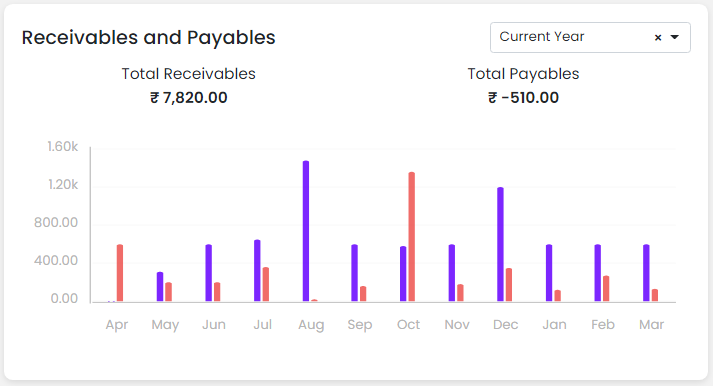

Accounts receivable made easy with mybooks

Using the software to manage the accounts receivable is a great idea! Yes, it helps your business a long way. You can efficiently optimize the process of accounts receivable with mybooks.

All the mentioned steps can be easily processed with mybooks simple accounting software.

Here is the simple and easy-understanding graph to know about your accounts payable and accounts receivable.

Advantages of using Accounts Receivable Software

Here are the advantages of using software for the accounts receivable process

- It improves your business cash position

- Raises the control over cash and working capital

- Improves the communication between you and your clients

- Increases the efficiency of accounts receivable management

- Reduces the cost of administration

- Decreases your sales payment cycle

- Enhances customer services and satisfaction

- Credit risks tend to reduce

Related Post

What is Accounts Payable Process | End to End Process of AP

The accounts payable (AP) process is responsible for goods and services payment for both suppliers and vendors purchased by the company. Read more