In this article, we’ll discuss and get the clear-cut difference between the Trial balance Vs. Balance sheet Vs. Profit and loss Vs. Income statement.

Topics we discuss,

What are profit and loss (P&L)?

The term profit and loss (P&L) will refer to your financial statement. It occupies and summarizes all your business’s expenses, revenue, and costs caused during the specific time.

The profit and loss records will deliver your company’s capable and non-capable information to generate earnings with cost reduction, revenue increment, or even both. These business financial statements are most frequently presented either in cash or on an accrual basis.

What is an income statement?

An income statement is one of the important financial statements. It allows businesses to report their business financial performance for a certain period of accounting. The other two financial statements are the cash flow statement and the balance sheet.

What is a trial balance?

A trial balance is nothing but a bookkeeping worksheet. It helps to balance all your business bookkeeping records, which are gathered as credit and debit column totals that are identical. In general, a business or a company will tend to prepare its trial balance at each reporting end period.

The main purpose and objective of preparing the trial balance are to make sure that the individual company’s bookkeeping systems are accurate as per the mathematics.

What is a balance sheet?

The balance sheet directs the company’s financial statement. A balance sheet will transfer your company liabilities, assets, and shareholder equity at a certain point in time. With the help of a balance sheet, it is easy for businessers to evaluate the business.

In simple terms, it is just a snapshot! Yes, it covers all about your business — i.e., what your company holds, what your company owes, each amount invested by the business owner, for every day.

With a balance sheet, you can easily evaluate, analyze and understand your business’s financial health and financial position.

Difference between P&L statement Vs income statement

The profit and loss (P&L) statement will describe your business’s earned profit and lost money for the specified period.

In general, the profit and loss (P&L) statement is also known as an income statement. There does not exist any distinction between both the terms. Both the terms refer to a similar definition.

The term income statement is also known as the statement of operations or statement of income. Since the terms income statement and profit and loss statement describe a similar meaning, we use both the terms by interchanging throughout the article.

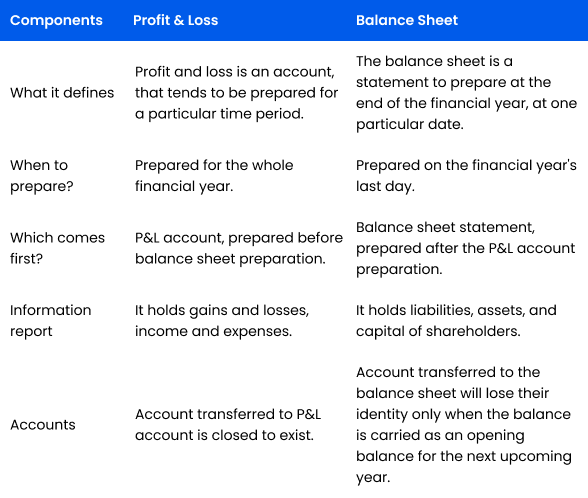

P&L Vs. Balance Sheet

From the three financial statements, profit and loss (P&L) and balance sheet are the two financial statements firms issue regularly. These records will indicate your ongoing business’s financial conditions, and the statements are used by the investors, creditors, and market analysis to estimate the potential of your business’s financial health.

The key difference between balance sheet and profit and loss statement

In general, the balance sheet is prepared at the end of the financial year, at one particular date. On the other hand, the profit and loss account tends to be prepared for a particular time period.

The balance sheet is a package of assets and liabilities statements, but the profit and loss account (P&L) is an account.

The balance sheet will express the financial position of the firm. The P&L account reveals the performance of the business finance.

From the balance sheet statement, you receive the company’s assets, equity, and liabilities summary. The profit and loss account will give an overview of the revenue and expenses of a company.

Firms will prepare the balance sheet based on the transferred balance from the P&L account.

What’s the difference between the trial balance and the balance sheet?

It’s more important to note that the balance sheet isn’t similar to the trial balance. Let’s explore the dissimilarity between the balance sheet and trial balance here!

The key difference between balance sheet and trial balance

The balance sheet will express the company’s assets, equity, and liabilities. If you take the credit and debit balance statement from the source of the general ledger, it is a trial balance.

The balance sheet will never include opening stock. The trial balance will never include closing stock.

As discussed earlier, with the help of a balance sheet report, you can estimate and analyze the particular date’s financial position. The trial balance assists the firm to estimate the arithmetical precision in the posting and recording.

The trial balance will not come under the financial statement. But, the balance sheet comes under one of the financial statements.

Once the trading and P&L Account preparation are complete, the balance sheet is prepared. The firm will tend to prepare the trial balance after posting it into the ledger.

Only the real and personal account balance gets displayed on the balance sheet. On trial balance, you can view the three accounts, namely – personal, real, and nominal accounts.

The company will prepare its balance sheet for both internal and external use. Conversely, the company will prepare the trial balance for only the purpose of internal use.

The firm will prepare the balance sheet end of every month. On the other hand, the company will prepare the trial balance at the end of every financial year, half-yearly, quarterly, or every month.