Businesses perform financial forecasting for various reasons such as firms’ business management, what-if scenarios, understanding working capital needs, and more. With accurate financial forecasting, businessers can easily achieve both their short-term and long-term goal.

Treasury professionals will help the business to go with the right flow with their forecastings. Preparing a financial forecast for a business is not an easy task – see this article on using Excel to create a financial forecast for more details. It is a complicated analysis process that is subject to challenges and limitations.

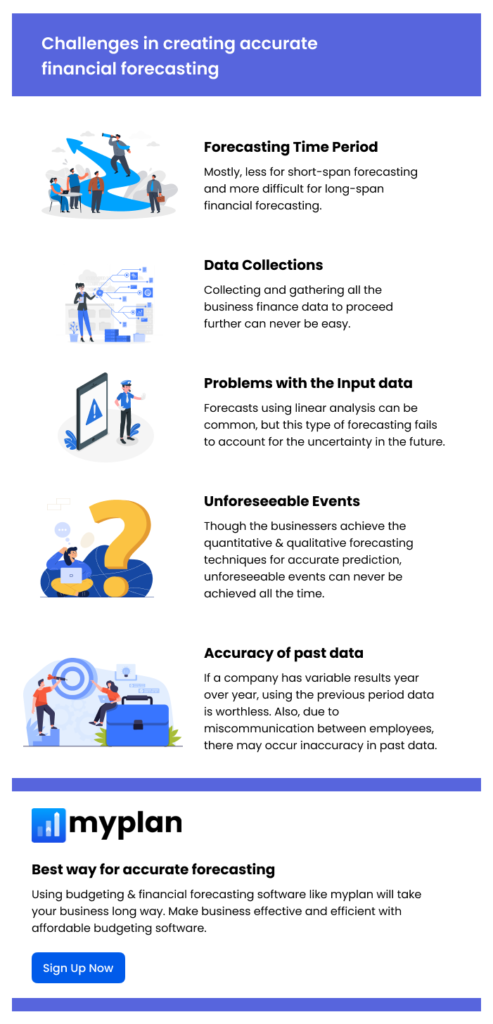

5 major financial forecasting problems

Forecasting Time Period

Shorter the period, the more accurate financial forecasting. Longer the period, the less accurate and difficult financial forecasting. Mostly, less difficulty comes for a short span and more difficulty comes for a long span.

Let’s take an instant that preparing forecasting for future 5 years, using past 5 years data is less difficult as compared to predicting for next 10 years. Even there might be variations in market shares or the business economic conditions.

In simple words, we say the shorter forecasting period will always be more accurate as compared to the larger prediction time.

Data Collections

It is really a big task. Collecting and gathering all the business finance data to proceed further can never be easy. This task can take a week to weeks to gather all the information to build the cash flow projection and revenue forecast.

What are the upcoming latest propositions that are likely to be traded? What are the dates that have started? Does there exist any chance to slip? This kind of query may feel the sales team more difficult. Collecting these data for forecasting is one of the huge financial forecasting problems.

And thinking about the customers is a little bit difficult. Whether they are going to continue their subscription? Do the clients pay on time? Does the invoice has sent out at the right time? These cannot be easily forecasted, and sometimes they cannot be done.

Problems with the Input data

Forecasts using linear analysis can be common, but this type of forecasting fails to account for the uncertainty in the future. In statistics, the assumption of linearity is necessary when certain assumptions are made about the future. However, there is no assurance that a relationship between two variables will continue in the future. In essence, noisy data can create a correlation where none truly exists.

Many factors come into play when you’re making a forecast, especially when it’s on an important matter. Human error–which is common–can mean the difference of millions of dollars in wrong predictions.

Unforeseeable Events

Another financial forecasting problem is unforeseeable. Though the businessers achieve the quantitative and qualitative forecasting techniques to make their prediction accurate, unforeseeable can never be achieved. These components can vary inherently, and reach the risks of forecasting.

For example, let us take a retail shop that opens the store with the pillar financial growth. It leads to affecting the other retail store in the particular area. It can never be forecasted.

Accuracy of past data

Financial forecasting is performed based on past business data to predict the future. Take an instant that your business average growth as 10% as a stable one for the past 4 years, you could predict your business finance for the next 4 years as 10%. While you use this kind of system wider, then you are on the way to financial forecasting problems.

If a company has variable results year over year, using the previous period data is worthless. Additionally, the financial data will not be available for the startups, as they should go by approximate estimation without any accurate idea.

There are also cases where the financial budgeting and financial forecasting get affected due to the external market cases, which are not captured by examining recorded results.

Tips to resolve financial forecasting problems

Here are the tips & solutions to fix the challenges in creating accurate financial forecasting

Not just historical data matters here!

It is not just that annual financial planning using only the historical data and linear analysis. The problem is, the forecasting can be applied most for the next six months. Later, the forecasting behavior tends to change due to market volatility or consumer behavior.

Rarely do financial planners discuss the external factors. Most organizations have to rework their accomplished financial forecasting when the pandemic hits the world. The problem behind it is, they failed to think and work for external factors.

The problem with the unforeseen is that it can never be predicted. But with the help of what-if scenarios, you can accomplish the right financial forecasting. Think more about scenarios that affect your business to make an accurate prediction and avoid prediction problems.

Effective teamwork to estimate the assumptions.

Working and communicating efficiently with your other department team members will help you to improve the forecasting what-if scenarios and reach the goals for accurate forecasting.

When acquiring the data from other departments goes difficult, people tend to fall for the projection of guesswork. It can never be right and don’t fall for that state. Instead, start to open up with your other department team members and have all the efficient data to work for the financial planning.

Using the technology for financial forecasting

One of the wisest decisions to solve your business financial forecasting problem is to use financial planning and budgeting software or application. It will help your business to large extent. One of the best business budgeting and financial forecasting software is myPlan. All iOS and web users can efficiently use the myPlan application.

Worrying about the cost? No worries, all small businessers can use the application without affecting your business budget. Analyze your what-if scenarios, give access to the required users, and see all your financial forecasting need on one dashboard. Sign up myplan for free!