Though budgeting and forecasting often come together, their concepts are different from each other. Both are not similar in their characteristics.

The difference between budgeting and financial forecasting comes under your business-specific roles. While budgeting paints the step-by-step financial plan displaying revenue expectations and expenditures over time, financial planning expresses what a company wants to reach with different characteristics.

Topics we discuss

Business Budgeting

Financial Forecasting

Key Difference

What is Budgeting?

Budgeting is the strategic planning approach made by a company to overcome and prevent the critical area of business finance. If a business wants to do budgeting, then they are required to draw up a budget plan.

The planned business budget outlines your business’s cash flow, daily expenses, and estimated revenue over a particular time. Planning your business budget has lots of upper-face. But one important feature of budget planning is a surefire way to score idea viability.

Here is what it means! When you start planning your business budget, you overcome and find difficulties to paint your business expenses and revenue plans. After accomplishing the complete financial outline, you can judge easily what can be achieved and what cannot be achieved. That clear picture can make your required iterations.

It is because both the revenues and expenses can never be predicted entirely. As budgets are short-term, generally on an annual basis.

Techniques of Business Budgeting

There are different types of business budgeting to help firms. Depending on the type of your business, here are six budgeting techniques that businesses can adopt.

Cash Flow Budgeting:

It is to account for potential lines of credits for raised business cash flow.

Value Proposition Budgeting:

It is used to make sure that each item in the budget achieves business value.

Activity-based Budgeting:

Businesses use this for mapping out an exact volume of inputs required to attain their projected business output.

Zero-based Budgeting:

It is used when your business is required to cut down costs and explain all firm expenses.

Incremental Budgeting:

In this type of budgeting, you add or subtract a portion from your earlier budget.

Surplus Budgeting:

It is to account for surplus revenue.

What is the main purpose of budgeting?

The objective of budgeting is to plan your business budget, organize and track them to improve your financial situation. In simple terms, we say business budgeting helps you to control and prevent all your unnecessary expenses by saving and making businesses stay on your budget for your long-term business financial goals.

Here are three aspects for budgeting

- To achieve profitability by forecasting income and expenditure.

- It acts as the best tool for business decision making

- Assist you in business monitoring performance.

Benefits of business budgeting

- Improves business decision-making

- Enhances planning

- You reach your business objective

- Business performance monitorization

- Handle the cash flow effectively

- Assign suitable resources to projects.

- Recognize where the crises occur – such as the demand to increase finance or cash flow tribulations.

- Grows staff’s motivation.

What is financial forecasting?

Financial forecasting assists you to estimate your future business financial outcome status with the help of your existing financial status. To create a financial forecast, check out the factors that influence your business finance. Additionally, consider the other influencing factors such as social and political that can swing your market.

The budgeting occurs for the short term. But the financial forecasting occurs for both the long term and the short term and consumes more time. Additionally, the companies have to prepare multiple forecasts, to have accurate forecasting for their respective business conditions.

Types of Forecasting

- Qualitative Forecasting or Judgment Forecasting

- Quantitative Forecasting

Qualitative Forecasting or Judgment Forecasting

On qualitative forecasting, the company stays confident in the knowledge of the market’s scenario and informed view of its marked audience for financial projections purposes.

Yes, of course, instant can never be right all time. So, this method can be utilized, only when the firm doesn’t have any historical data to make decisions. For instance, if you launch a new product or service, financial forecasting can be made only with faith and not with the actual data.

Quantitative Forecasting

Quantitative forecasting directs to data-backed business forecasts. It is the type of forecasting that involves the proper way of planning without making decisions as qualitative forecasting. It collects and analyzes all the information to find the condition of marketing, economic pattern, customer behaviors, and trends in the industry. By influencing all the collected data, the forecasting plan will be built.

Some industries merge both qualitative and quantitative forecasting to estimate future costs to predict the best.

What is the purpose of financial forecasting?

The main purpose of financial forecasting is to estimate the existing and future fiscal conditions to make better business decisions. Financial forecasting is the tool that helps businesses to estimate business informations based on the past, existing, and projected financial conditions

Benefits of Financial Forecasting

- Furnishes better cash flow management

- Reduced financial risks

- Estimate the future cash requirements

- Approaching investors for allowance and funding

- Assign the right business goals and budgets

- Answering your business what-if scenarios

Budgeting Vs. financial forecasting | With Tabulation & Infographic

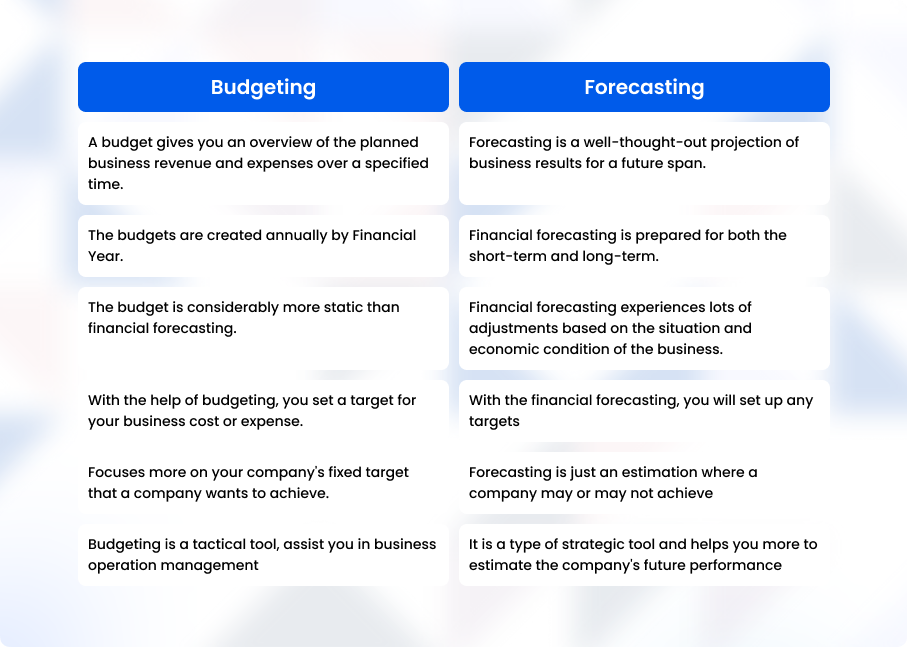

Without analysis and understanding, both budgeting and forecasting look similar. In actuality, they are not. Both are different from each other.

Difference between budgeting and forecasting

A budget gives you an overview of the planned business revenue and expenses over a specified time. Forecasting is a well-thought-out projection of business results for a future span.

The budgets are created only for the short term. Financial forecasting is prepared for both the short-term and long-term.

The budget is considerably more static than financial forecasting. Financial forecasting experiences lots of adjustments based on the situation and economic condition of the business.

With the help of budgeting, you set a target for your business cost or expense. With financial forecasting, you will set up any targets

Focuses more on your company’s fixed target that a company wants to achieve. Forecasting is just an estimation of where a company may or may not achieve

Budgeting is a tactical tool, assists you in business operation management. It is a type of strategic tool and helps you more to estimate the company’s future performance

Why are budgeting and financial forecasting important?

Importance of budgeting for business

- With the help of the right budgeting, businessers can control their spending. It might look smaller amount when you spend smaller. But as all we know, every smaller spending can lead to a larger amount.

- It takes you on the right path to reach your financial goals, without diverting to some other path.

- With suitable budgeting based on your business and business needs, you will always know and you will always have money for the things you need.

- Easily people can make an alignment for current and upcoming monthly expenses.

- Avoids individuals from excess borrowing

- People will feel relaxed and less stressed when there is a shortage of money. Because budgeting is accomplished already, people can adjust their money with prioritized and non-prioritized spending.

Importance of Financial Forecasting

- Financial forecasting will act as a base for making business decisions.

- As discussed above, you can display to the investors and creditors that your company has certain plans for future financial goals and for unforeseen events which affect the company’s budget and revenue.

- It acts as a barometer for making and taking financial decisions.

- You will always be prepared for the worst and best business scenarios.

What comes first for your business? Either budget or financial forecasting.

As business planning, both budget and financial forecasting are important for business!

But what comes first? It comes to every businessers mind.

Businesses lure to create a budget first! After all, you ought to hit the ground rolling and plan out revenue and expenses for the month, quarter, or year.

Just a minute! Take a break

Without financial forecasting, your result will be on spending resources on efforts that were not aligned with your financial goal of a business.

So, just explore first with the forecasting.

With the help of realistic financial forecasting projections, you can create super-duper budget planning to reach your various business goals.

The bottom line

Though to create financial forecasting first, budgeting is also important for businesses. It is challenging for businesses to estimate financial forecasting. There is the best financial forecasting software for businesses, to make your business go with ease.

The myPlan is one of the best financial forecasting software that helps businesses to meet their objectives effortlessly. Check your future financial status effectively with the myPlan what-if scenario feature.

Also, Read

Basics of small business accounting

The key to the survival of your business is to understand and maintain its financial health. Read More

Tips to maintain business finance

Managing business and maintaining accounting and bookkeeping in an organized way is a difficult process. Read More