The terms liquidity and solvency refer to the business’s financial health with few notable differences. Both solvency and liquidity are important for the company’s financial health and to reach the business obligations.

Liquidity refers to measuring your business’s capability to use your current assets to meet the business’s long-term obligations. The term liquidity also refers to the capacity of the company to sell the assets fast to increase the cash. And, the term solvency refers to meeting your business’s short-term focus.

The topic we discuss,

- What do you mean by liquidity in accounting?

- Liquidity ratio

- Most popular liquidity ratios

- What is the liquidy risk?

- Solvency ratio

- How do you measure solvency?

- What’s the formula for the solvency ratio?

- Steps involved in the solvency ratio calculation

- The most famous solvency ratios

- What is solvency risk?

- What’s the difference between solvency and liquidity?

What do you mean by liquidity in accounting?

In the case of accounting, liquidity refers to the business’s capability to pay the liabilities at the specified time, without any time delay. Additionally, liquidity also refers to how easily the business can transform an asset to cash in a short span with a minimal discount.

Assets such as bonds and stocks are considered liquid. The reason behind this is, those assets have an active market with lots of buyers and sellers. If a business or a company lacks liquidity, it’ll be pushed to insolvency, though it is solvent. It is important to maintain liquidity for your business

What is the liquidity ratio?

A liquidity ratio is a kind of financial ratio operated to estimate the firm’s capability to pay its short-term debt obligations. The metric helps firms to determine whether the company can utilize their current, or liquid, assets to cover their current liabilities.

The most popular liquidity ratios

Here are the most popular liquidity ratios for the business.

- Current Ratio

- Quick Ratio

- DSO (Days Sales Outstanding)

Current Ratio

A current ratio is a liquidity ratio that calculates your company’s business liability to pay the short-term focus. Sometimes, the current ratio is called the working capital ratio. The current ratio is also known as current because it contains all current assets and current liabilities.

The current ratio calculates the company’s liability with the current assets such as account receivable, inventory, and cash. If the current ratio is higher, it is denoted that the company has a better liquidity position.

The Quick Ratio

The quick ratio is the arrow for the short-term liquidy for your business. It calculates the capacity of your company, whether it meets the short-term obligations.

OR

The quick ratio will not include the inventories for the current assets. Additionally, the quick ratio is pointed to as the “acid-test ratio.”

DSO (Days Sales Outstanding)

The day’s sales outstanding (DSO) itself says that it calculates the average days taken by a company to collect and complete the payment for a sale. Most of the firm calculates DSO monthly/quarterly/annually.

What is liquidity risk?

Liquidity is the capability of a company to pay its debts without suffering from destructive losses. Contrariwise, the liquidity risk grows to form the scarcity of marketability of an investment. It cannot be recovered in a short period to minimize or prevent the loss.

Liquidity risks are low when compared to solvency. Moreover, liquidity impacts your business’s creditworthiness.

For high DSO, a company takes an excessive time to collect a payment, and additionally, it is tied up with the receivable capital.

What is the solvency ratio?

A solvency ratio is a performance metric that supports businesses to evaluate a company’s financial health. In individuals, it allows us to estimate whether the firm can fulfill its financial responsibilities in the long term.

How do you measure solvency?

As discussed earlier, solvency denotes the business’s financial position for the long term. If a business has a positive net worth, we refer as a solvent business. In this case, the total assets are more when compared to the total liabilities.

With the help of the solvency ratio, we measure the solvency. You can assess the business’s capacity to pay off its long-term debts and interests on debts.

What’s the formula for the solvency ratio?

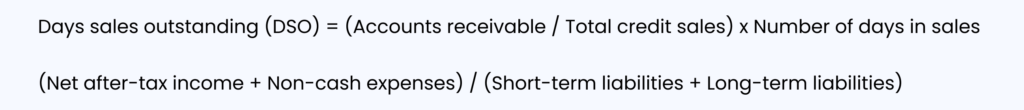

The solvency ratio formula is,

Steps involved in the solvency ratio calculation:

STEP 1: Add all your non-cash expenses with the after-tax business income. The acquired is your business’s approximate generated cash flow.

STEP 2: Add your business’s short-term liabilities with the long-term liabilities.

STEP 3: Divide the adjusted net income by the entire liabilities.

The most famous solvency ratios

Here are the most popular solvency ratios for the business.

- Interest Coverage Ratio

- Debt-to-Equity (D/E)

- Debt-to-Assets

Interest Coverage Ratio

The interest coverage ratio is a debt. It is used to calculate about the company as to how the company pays its interest due on outstanding debt.

Not only EBIT (earnings before interest and taxes), some interpretations of the formula uses EBIAT or EBITDA to calculate the interest coverage ratio. If the ratio has a higher interest coverage, the company has a better ability to cover the respective interest expense.

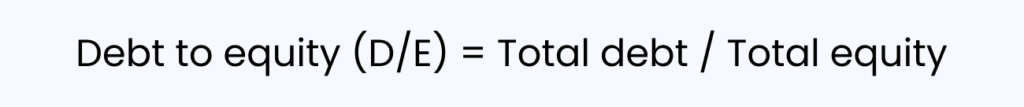

Debt-to-Equity (D/E)

The D/E ratio is used to measure your company’s financial power. This ratio indicates the DFL (degree of financial leverage). It contains both long-term debt and short-term debt.

The higher D/E ratio indicates the company’s higher interest expenses. When it crosses its saturation point, it results in affecting your company’s credit ratings. Concluding with more expensiveness will raise more debt.

Debt-to-Assets

The total-debit to total-asset ratio measures the company’s total amount of debt relative to the total amount of assets.

The Debt-to-Assets is a leverage ratio. When the ratio of debt-to-asset is higher, your company will result in financial risks with a greater degree of leverage.

What is solvency risk?

The solvency risk is a risk that tends to arise when the firm cannot able attain its financial responsibilities or obligations. A completely insolvent firm cannot pay its debts on time and will be put into bankruptcy. So, investors must be conscious of calculating and analyzing all the financial statements of a firm to make the company profitable and solvent.

What’s the difference between solvency and liquidity?

Solvency Vs Liquidity | Infographic

Difference between liquidity and solvency

Definition

In a firm, liquidity is defined as the capability of the firm to pay off current liabilities with current assets. Whereas, in a firm, solvency estimates the capability of a firm to meet its debts as they fall due to payment.

Obligations / Responsibilities

Liquidity is a Short-term Responsibility and Solvency has a Long-term obligations

What it’s all about?

Liquidity is a short-term vision, holding required cash and cash equivalents to pay off the current debts. And, Solvency is a long-term vision. It represents how well the business operations are performing to run the firm effectively.

Why do we use it?

Liquidity is used to calculate how your business assets are transforming into cash, and solvency is used to calculate whether the firm can perpetuate them for the future, without obstacles year after year.

Their Risks

Liquidity is low in risk when compared to solvency. Moreover, liquidity affects your business’s creditworthiness. Whereas, solvency is extremely risky when compared to liquidity and results in bankruptcy.

Ratios

Liquidity Ratio: If you measure the business liquidity, it is the liquidity ratio. The most popular liquidity ratios for the business are the current ratio, quick ratio, and DSO (Days Sales Outstanding).

Solvency Ratio: If you measure the business solvency, it is the solvency ratio. The most popular solvency ratios for the business are Interest Coverage Ratio, Debt-to-Equity (D/E), and Debt-to-Assets.

What to examine on the balance sheet

Liquidity: Current assets, current liabilities, and a comprehensive account of every item underneath them.

Solvency: Long-term assets, shareholders’ equity, and Debt.

Consequences on Each Other

Liquidity: In case of a rise in solvency, a business can attain liquidity in a short time.

Solvency: In case of high liquidity, a business can never attain liquidity faster.

The bottom line

The term solvency and liquidity is important concept for business. Though both calculate the company’s capability to pay its debts, it can never be used by interchanging. As both the terms solvency and liquidity are from their purpose and concept.

Moreover, it is necessary to understand the difference between solvency and liquidity. Once you find the difference between them, it is easy for you to make effective business decisions. So make sure to know the concept and difference between solvency and liquidity.

FAQ’s

What is the difference between liquidity and profitability and solvency?

In firms, the liquidity ratio represents the organization’s capability to meet short-term liabilities, the solvency ratio represents the organization’s capacity to meet long-term obligations, and the profitability ratio estimates the organization’s capability to generate profits.

What does long-term solvency refer to?

Long-term solvency refers to the hazard that a business is unable to pay its respective long-term debt.

What is the short-term solvency ratio?

A short-term solvency ratio is utilized to evaluate the current financial status of a business by estimating the assets recently utilized by the profit or loss made in the company. It has lesser liabilities and more possibilities of healing from debt loss.

Why do we calculate the solvency ratio?

Solvency ratios are especially utilized by prospective business lenders to evaluate the solvency state of a respective business. Firms that hold a higher solvency ratio are considered to satisfy the debt obligations, while firms with a more inferior solvency ratio are more potential to pose a threat to the banks and creditors.

What is a good solvency ratio?

The good solvency ratio will tend to vary for every industry. But, when it comes to a good solvency ratio, then as a general rule, the solvency ratio of less than 20% or 30% is considered to be healthy financially. Lesser the solvency ratio of a company, the larger the probability of a company’s default debt obligations.

What are the 4 common liquidity ratios?

- Cash Liquidity Ratio

- Operating Cash Flow Liquidity Ratio

- Acid-Test Liquidity Ratio

- Current Liquidity Ratio

Is a cash ratio A liquidity ratio?

Yes, the cash ratio is the liquidity ratio, which calculates the capacity of a company to pay off short-term liabilities with high liquid assets.

What is a good current ratio?

The good current ratio varies from 1.2 to 2. It implies that the company has two times more current assets when compared to the liabilities to conceal its debt. If the company’s current ratio is below 1, it indicates that the company doesn’t have sufficient liquid assets to shield its short-term liabilities.

Related Articles

Complete Cash Flow Statement

A cash flow statement is used to determine the cash that enters and leaves your business. After the balance sheet & income statements, the cash flow statement is 3rd most key financial statement. Read more